Is the ‘Bank of Mum and Dad’ Good or Bad?

If your children or grandchildren need a helping hand to get onto the property ladder, they may turn to the so-called ‘Bank of Mum and Dad’. You may have considered offering them money to help, as the Bank of Mum and Dad (BoMaD) is being used more and more each year.

According to a recent report by Legal and General, this year family and friends in the UK gave their loved ones an average amount of £24,100. Which has increased by more than £6,000 compared to last years £18,000. This means that both volumes and lending are rising. The Bank of Mum and Dad is set to lend over £6.3bn, being increasingly larger from its height of £5.7bn last year.

The Bank of Mum and Dad

It’s now quite common for young people, and particularly first-time buyers, to receive a contribution from parents or other family members to help with a house purchase. With the need to provide ever-increasing deposits, the Bank of Mum and Dad is now busier than ever.

The Bank of Mum and Dad is now in the UK’s top ten largest lenders. So, it’s essential parents and their children know the rules for both their own financial protection and peace of mind.

So, here are some questions that parents or grandparents should think about before deciding to help their loved ones.

Can I afford to help?

You need to think about whether you can afford to help. You may have a reasonable amount of money tucked away in savings, but will you need that money in the future? What if you lost your job or needed to go into a care home? Would lending the money affect your current or future standard of living?

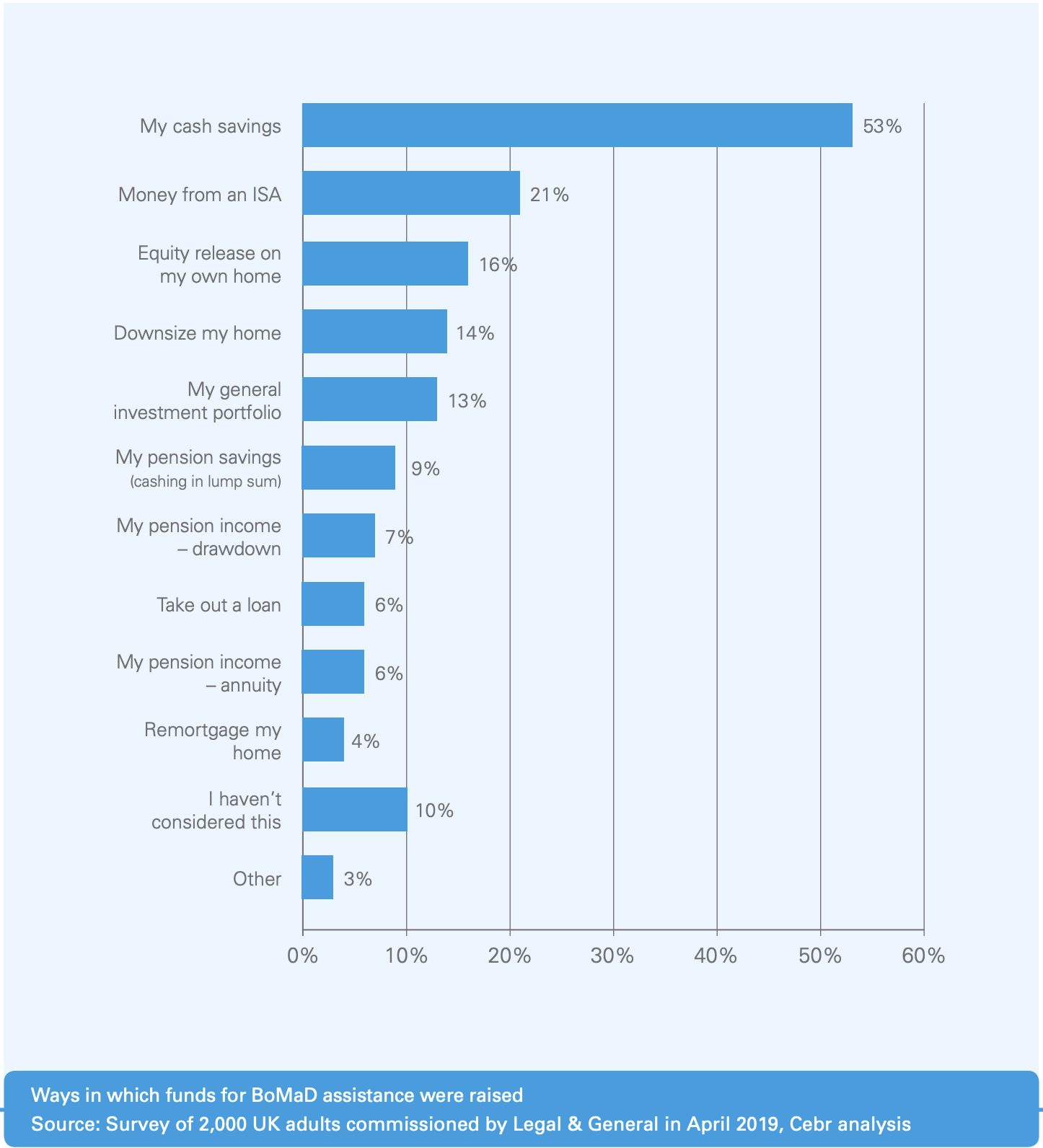

According to Legal and General, 6% of parents or grandparents chose to take out a loan to further borrow to help support their loved ones. You need to assess your financial situation and your future needs, and use that to determine what, if anything, you can afford to offer.

Source: Legal and General 2019 Report

Should I gift or loan the money?

According to the Legal and General report, 57% of family and friends who gave money to their loved ones did so by giving it to them outright as a gift. 18% offered support in the form of an interest-free loan, and 5% gave help via a loan on which interest was charged.

The most suitable option for you will depend on your circumstances.

Do I need to help my other children or grandchildren?

How many children or grandchildren have you got? Will anyone else need support? Will there be any family resentment if you offer financial support to some but not others?

Family life and the dynamics of it can be challenging. So, thinking hard and long about this is key when deciding what to do. Would it be better to treat everyone equally and give them all a small sum to help fund a deposit, or would your family prefer you to offer extra support to someone who is struggling more than everyone else? Be sure to ask yourself these questions.

What does being a guarantor include?

If your child or grandchild asks you to act as a guarantor, make sure you know what you may be agreeing to. In reality, they are effectively asking you to guarantee to their mortgage lender that you will pay their mortgage and otherwise abide by its terms. This is a huge commitment for which you may need to seek some expert advice.

Can I say no?

If having thought about things, you decide you are not able to help… that’s more than fine. However, breaking this news can be difficult. But, ultimately, it is better to be honest and explain your reasons rather than agree to fund something you cannot afford, or you are uncomfortable with.

Thoughts?

So, all in all, what do you think? Is the ‘Bank of Mum and Dad’ good or bad? Weighing up the pros and cons, there is a lot to think about if you’re thinking about helping out your child or grandchild. For other methods of helping fund your loved ones, why not read about a personal loan? It could be something, you’d be interested in…